History Fund Grants

2016 is a critical year for the History Fund’s tax refund check-off. The grants are funded by a tax refund check-off: when Ohioans file their state tax refunds, they have the option to donate a certain amount of their return – any amount they choose – to the History Fund.

To maintain this check-off, the History Fund must generate $150,000 every year. If it doesn’t meet this goal two years in a row, the tax check-off gets removed. During the first three years of the income-tax check-off program (2012-2014), the History Fund tax check-off averaged more than $154,000 a year in private tax refund contributions.

In 2015, all of the state’s income tax check-offs inexplicably dropped 45-53%. The Ohio History Fund contributions dropped from more than $171,000 in 2014 to just under $80,000 in 2015.

Even though 2016 tax season is over, you can still make a difference in saving the History Fund! Click here to tell your legislators to give tax check-offs more time!

About the History Fund

The Ohio Historical Connection’s History Fund is a matching grants program funded by voluntary contributions via Ohioans’ state income tax returns and by gifts to the Ohio Historical Society designated to the History Fund. Tax year 2011 marked its first year of operation, making it one of four “tax check-off” funds found on Ohio’s personal income tax form. It is currently the only such fund dedicated to supporting history-related projects.

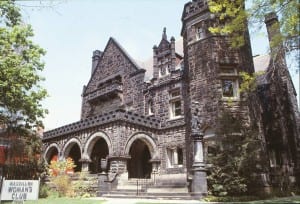

History Fund grants are competitive and require a match from recipients. Eligible history projects fall into one of three broad grant categories: “Organizational Development,” “Programs & Collections,” and “Bricks & Mortar.” A body of representatives from history-related organizations across Ohio will determine grant recipients, and the Ohio Historical Society provides program support and administration.

Learn more about History Fund grants. The guidelines for the program describe eligibility, allowable projects, and criteria for grant awards.